In a time of complex financial advice, the simplicity of the 50 30 20 budgeting method is a welcome respite. Whether you're starting your first career or you just want to regain control of your finances, this no-frills rule is a simple answer. It's a technique that can be used for people at all income levels and stages of life. If you want to know how to divide your income smartly without a finance degree, keep reading.

The good news? It's an easy budgeting system that doesn't involve spending hours tracking every coffee or impulse buy. Instead, it teaches you how to divide your money into three general buckets and make smarter decisions with less stress. If you've been looking for simple money rules that actually work, the 50/30/20 rule may be your new best friend. Here’s all about how to divide your income smartly, budgeting by percentages, easy budget framework, beginner-friendly money rules, and more.

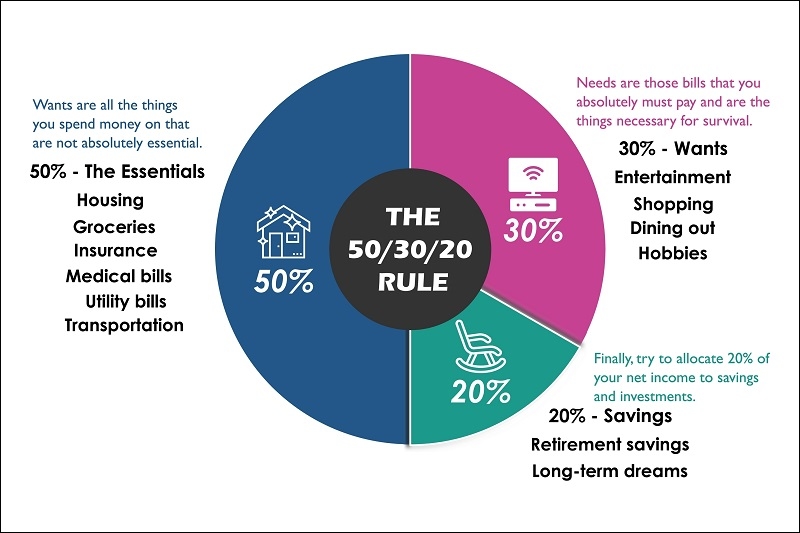

The 50 30 20 budgeting system was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth. It divides your after-tax monthly income into three groups of essentials: 50% for essentials, 30% for luxuries, and 20% for savings and debt payments.

At first glance, this may look like another budget trickery, but it's actually a lot more than that. It's structured but not too restrictive. It sets you free to live your money today and plan for tomorrow, too.

So, what does each percentage actually stand for?

This is budgeting by percentages in its most efficient form. You’re not just creating a budget—you’re building a sustainable lifestyle.

There are numerous budgeting systems out there, from zero-based budgeting to envelope budgeting. But they all require some form of fiscal responsibility that can seem overwhelming, especially for first-time budgeters. That's why the 50 30 20 budgeting system is so popular. It is realistic and adaptable, a workable method of managing finances.

If you've ever grappled with how to divide your income smartly, this system gives you a blueprint. It doesn't ask you to track each penny, but instead, step back and see the larger picture. With three categories, you can instantly see if you're overspending on wants or shortchanging your savings.

This ratio system also causes the system to scale well. Whether you earn $2,000 a month or $10,000, the ratios are the same. It's an equal-opportunity budget—another reason it's one of the most newbie-friendly money rules available.

Now, let's deconstruct how to actually apply this system to your everyday life. First, determine your after-tax income—that is, what lands in your bank account after taxes, insurance, and other deductions from payroll. This figure is your foundation.

Then, apply the 50 30 20 budgeting rule to make your decisions.

One of the best things about the 50 30 20 budgeting method is that it is extremely flexible. Life isn't always neatly boxed up, and occasionally your income isn't either. If you live in one of those high-cost cities, like New York or San Francisco, you might find that your "needs" exceed 50%.

The problem is not perfection but awareness. Maybe you experiment with 60/20/20 or 70/20/10 for a while. The goal is to work incrementally toward being financially balanced. Knowing how to distribute your income wisely means knowing when your needs are bulldozing others aside—and doing something about it.

You can also tweak the rule to your needs. Want to pay off debt faster? Contribute more to savings. Have a big vacation planned? Increase the "wants" budget temporarily, but intentionally. The key is to have money serving you—not the other way around.

There is a second reason this process is so effective. It is psychologically easy. Complex budgets are really frustrating. You begin strong, but it is such a hassle to log each expense that you drop the effort after a while. You go back to being financially chaotic.

The 50 30 20 budgeting plan doesn't fall into this trap. It gives you a rough idea that's easy to understand and stick to. You can't justify every expenditure—just stay within the right buckets. That's why it's one of the best money rules for newbies.

It also instills discipline without punishment. If you want something that's not currently in your "wants" budget, you'll need to plan for it. That delayed gratification builds healthier financial habits over time.

There's something empowering about looking at your financial life in percentages. You're no longer reacting to money—you're making thoughtful choices. Over time, this model can yield:

By repeating this easy budgeting plan month in and month out, you inch closer to more financial security. And you do it without sacrificing today's pleasures. In short, you balance your life.

No method is perfect, and even the 50 30 20 budgeting method has its hiccups. Sometimes you’ll overspend on wants. Other times, an unexpected medical bill or car repair will mess up your needs category. Life happens.

The secret is not to fail. Rebudget next month's expenses accordingly. Maybe scale back some takeouts or put off that new gadget. One of the reasons that this strategy is effective in the long term is that it's forgiving. It's not about getting it spot-on each month—it's about being close to a realistic range over the long term.

If you still struggle to split your money properly, you may want to try apps that break your expenditure as a percentage of how much you spend. Most budget apps and bank apps offer this, so it has never been simpler to organize your finances.

Ultimately, it doesn't have to be as difficult as it seems to control your money. The 50 30 20 budgeting approach is a simple but powerful way to simplify your money, get rich, and enjoy yourself. It's a favorite strategy for anyone who wants simple-to-implement money rules that work.

So if you've ever opened your bank account and wondered where it all went, now you can get back in charge. Percentage budgeting gives you a clear, reproducible formula for financial success. And with this easy budget template, you don't have to be an accountant to do it.

Start today. Take a look at your income, apply the 50/30/20 rule, and see where you stand. It starts with awareness. Then comes action. And with a little consistency, you'll be on your way to a safer, less stressful financial future.

This content was created by AI